Are Incentives to Blame at Wells Fargo?

Are incentives to blame at Wells Fargo?

The news gives us a couple of narratives regarding the Wells Fargo Fake Accounts scandal. In case you’re unfamiliar with the details, the fraud centered around employees at the bank cutting corners and opening deposit accounts and credit cards for Wells Fargo customers without their knowledge or permission. This didn’t happen once or twice. 5,300 employees opened 1.5 million times over five years. In late 2016 Wells Fargo was ordered to pay $185MM in fines. That led to the revelation that key executives, specifically John G. Stumpf and Carrie L. Tolstedt, made fortunes during this time period. Hundreds of millions of dollars that have been recently returned, the “clawback.”

Incentive? Culture?

The blame has alternately been placed on the incentive structure and the culture. As recently as last month, a top Federal Reserve regulator, William Dudley, said, “Incentives shape behavior, and behavior drives culture.” http://www.reuters.com/article/us-usa-fed-dudley-culture-idUSKBN16S0RW

That makes sense, doesn’t it? Effective compensation needs to have a couple of features. One is that it needs to be externally competitive – a company can’t pay less than its competitors. Second, as the Fed Chair alludes to, effective compensation needs to be internally consistent with the company’s culture. So it only makes sense that if you reward the wrong behaviors, you can change the culture.

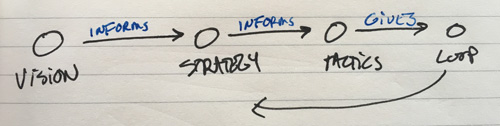

That puts the blame too squarely on incentives for my taste. Incentives, by their nature, are tactics employed by strategy to achieve a company’s vision. It flows like this:

As Alan Weiss teaches us in Best Laid Plans, it starts with vision – the mission, the values. Strategy comes from that vision – the goals, the culture. Then tactics come from strategy – the structure, the accountabilities. Incentives are a tactic and there’s no doubt they shape behavior, but I’ll submit that the issue at Wells Fargo goes back even further than vision.

What drives the business?

In my work, to get to vision my clients answer the question, what is driving the business? We boil it down to one of a handful of factors: products/services, the market you service, technology, a resource, production capability, distribution, growth, or profit. For example, what drives Amazon? I submit that it’s distribution. They are the infrastructure of business because they reach everyone. If you want to reach everyone, get with Amazon.

That’s where the problem with Wells Fargo originated. Wells decided that their distribution is what drives the business. They have a sales channel and branches on every corner. When you think distribution is your driving force, your vision is based on your ability to sell more products through your channels. That vision informed the strategy, which installed the tactics to get there. So yes, it’s culture but it started with that vision of what drove their business. The major issue with Wells Fargo thinking that their distribution is the driving force of the business is that public and the government have another assumption. The assumption from the public and the government is that Wells Fargo’s main driver for a bank is market served. As evidence, think of all the rules and regulations around banks. Those are set up to make sure the markets they serve are not harmed.

Nail the driver

My advice is this: before you get into compensation, before you get into strategy, before you nail down your vision, get the business driver right. And if you’re in a regulated business, pay particular attention to what the regulators think your business driver is.

Good stuff.