I Want That

I Want That

This article originally appeared in Amalgamate: A Mix of Ideas for Your Business, Summer 2015

Today there is a lot of cash in the system looking for opportunities. The press is full of Mergers and Acquisitions news. I just saw a 2015 stat that shows trillions of dollars available for either Strategic or Financial deals. The investment banker even used the word “frothy.” Those dollar amounts get executive’s minds racing and cause their eyes to wander. And like my youngest would say whenever he saw a toy commercial, “I want that.”

Here’s a shocking statistic that was quoted in the same report: over 80% of mergers and acquisitions fail to meet expectations. I dug it up and that stat was from a 1999 KPMG report. A McKinsey report from 2010 reported similar findings of 66-75% failure rates. Considering the dollar amounts and livelihoods of the professionals involved, it’s sobering.

I want to share this thought from Constance Dierickx, Ph.D. “Consider the tendency for people to be over-confident when forecasting. What will it mean if you are overconfident by even 5%? You’re far better off challenging yourself now than wishing you had done so later.”

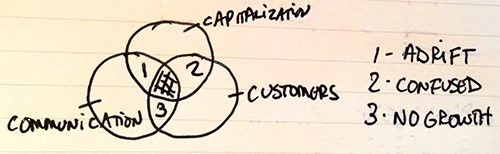

To help challenge yourself she offered up the 3 most important elements of a Successful Integration:

Communication, Customers, Capitalization.

Moving through the graphic,

(1) if you have Capital and Communication but fall short when bringing along your Customers, the merger will go Adrift. No traction.

(2) If you have Capital and a focus on the Customers but haven’t Communicated the goals of the merger clearly, the integration will suffer from Confusion. It will lose sight of the strategy.

(3) And if you have the Customer strategy and tactics figured out and have Communicated clearly and purposefully, but you are missing the Capital required to fund the integration, there won’t be Growth. Something I’m intimate with.

With this framework in mind, you can run a diagnostic on your M&A activities at any time. To do that, rate your firm on a scale of 1 to 5 in each area: Communication, Customers and Capitalization. Use 1 to signify “we haven’t thought of this” and 5 if you can say, “I’m supremely confident in our efforts here.”

Add up the 3 scores. Out of 15 points total, if you’re below 12 consider bringing on a Project Coordinator to keep you on track.

The Project Coordinator serves one role. To keep integration activities on track. A functional outsider that understands the expectations, recognizes any shortfalls, and addresses these areas:

IT | Accounting | HR Policies | Sales | Legal | Risk

Your competitive advantage in the marketplace isn’t because of your team’s ability to enter into a Merger or Acquisition. Your advantage will come from your ability to keep both sides of the deal on track to beat the averages that hold competitors back.

Good stuff.