The Process of Growth

The Process of Growth

Growing Pains

“We’ve managed pretty consistent growth up to this point.”

“Then why am I here?”

“Because you come highly recommended and I’ve heard you can help us.”

It’s true. I can help. My clients can kick ass because they have a deeper understand their customer’s buying process, put processes in place to educate buyers and have greater insights into their pipeline/leading indicators. It’s business development. What I want to cover here is the first concept we discuss. One that will help you on your path to kicking butt: The Process of Growth.

I use 3 analogies/visuals to help describe what’s about to happen on the journey to growth. The lobster, the barbell and the baby. If I’m lucky, the first analogy sticks and if that doesn’t work one of the other 2 analogies helps bridge the gap. I’m called in because the executive wants more visibility into their business development process. Pipeline management. Leading indicators. The crystal ball.

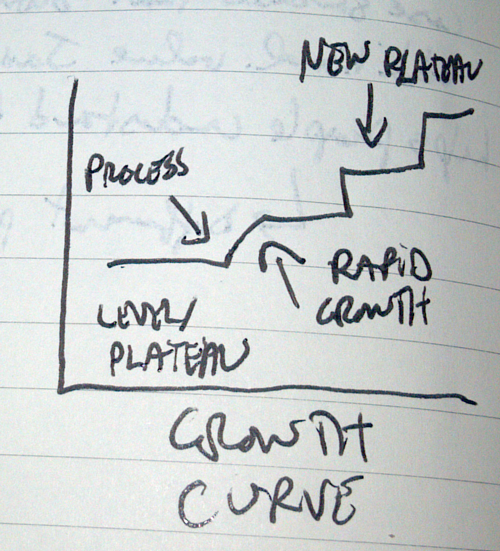

The first thing I try to tease out is whether we’re trying to “fix” a dip in revenues or if we’re trying to “innovate” for more growth. I’ve run through those examples in this post You Don’t Fix Your Way to Growth. There you find the illustration of Innovation for growth represented on a trend line:

S Curve of Growth

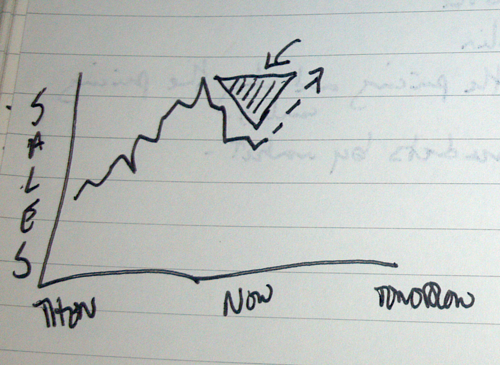

and the illustration of Fixing as a trend line.

Slim’s Sales Chart

Once we’re on the same page in talking about the growth that is going to occur in the coming year, I try to describe the biggest challenge that occurs in the Process of Growth:

Risk

Lobster Analogy for growth risk: Getting to a new plateau requires some risk to the business and the culture of the organization. Much like a lobster shedding its shell.

If the lobster is going to get any bigger, it needs to shed its old shell and expose itself to danger for weeks while the new one grows hard. Your organization is going to experience some of the same risks in order to reach its next plateau.

Pretty simple, eh? Most people get it at that point, but if I need to revisit that concept, a barbell illustration works well.

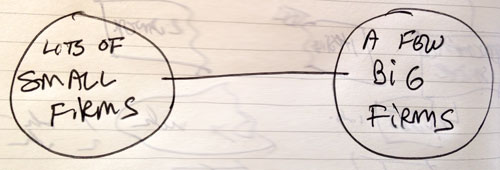

Barbell Visual for growth risk: To make sure we’re on the same page, taking your firm to the next level/next plateau will expose your firm to some risk along the way. I view your market this way – a lot of small to mid sized firms duking it out on one side of the barbell and some giant established firms focused on internal issues on the other side.

The Barbell

What you’re doing is taking your mid-sized firm and you’re moving across the bar to the other side. The reason your industry has this “barbell effect” is because that “bar” is risky. It takes capital and a culture change in addition to the ability to find new business. Your organization is going to be on that “bar” until you reach the next plateau.

And finally, if I still haven’t gotten buy-in on the risk of growth, I pull out the Baby.

Baby analogy for growth risk: This process you’re about to embark on has its upsides, but there are risks for your firm to be aware of and mitigate. It’s like parenting a child. As a baby, that child is exposed to all sorts of risk that you work to shield it from. As the baby grows, the risks change and the child can work their way through many issues on their own, but each step toward adulthood has its corresponding risks.

Does that make sense?

Reading all 3 of these in a row makes it sound like I’m trying to scare my clients but I rarely use them in rapid fire succession. I get some agreement and move on to the next communication sticking point.

If there’s a lesson you need to take from reading this, focus on the origins of these tools. What has happened, will happen. If one person gets stuck on a concept, someone else will too. Have 3 ways to explain these sticking points.

Good stuff.

About the Author: Greg Chambers is Chambers Pivot Industries. Get more business development ideas from Greg on Twitter.